The Difference Between Bookkeeping and Accounting, and Their Business Benefits

In running a successful business, one must have a good grasp of its financial standpoint.

Accountants, bookkeepers, and auditors have always been an essential part of every business.

Your accounting team is here to set you up for success as they ensure your numbers add up in running payroll to increase profitability.

Oftentimes, people are confused between bookkeeping and accounting. So, how are they different from each other? Continue reading to know the answer.

In the Philippines alone, accounting is one of the most popular career paths and there are several investments towards growing a pool of experts in this field.

The global accounting services market is valued at $868 billion by 2022 and is one of the most in-demand business process services to date.

Even more on jobs, bookkeepers and accountants hold over 1.4M positions in the US alone, making these ones of the most in-demand positions in companies nowadays.

As we go on, we'll answer what is the difference between bookkeeping and accounting and their benefits to your business.

There is a high demand for this because 72% of small businesses and self-employed professionals do their own bookkeeping and this can put them at risk of errors.

About 18% of them are interested in seeking professional help.

Around 2% rely on friends and family to do their bookkeeping. This presents a great demand for outsourced accounting professionals year after year.

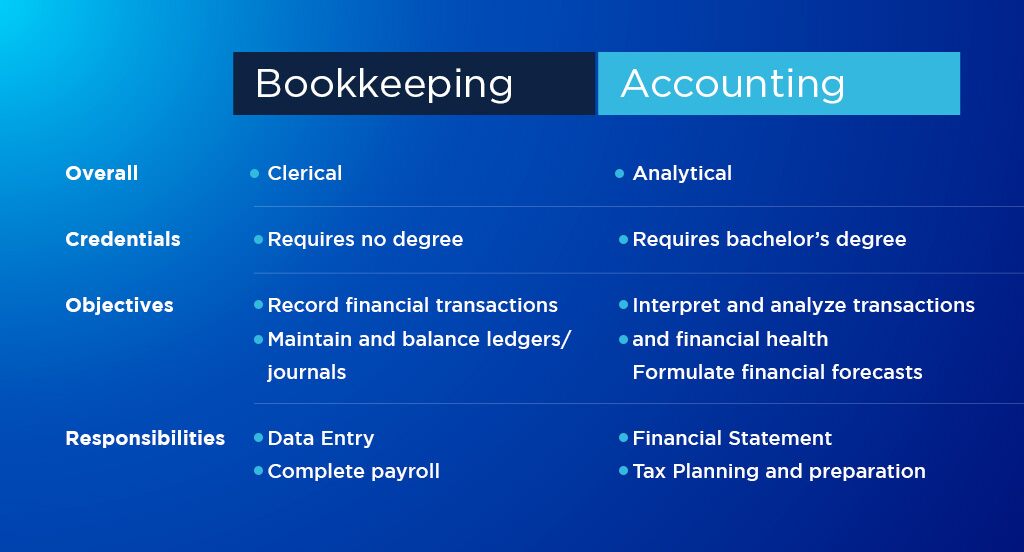

Difference between accounting and bookkeeping

Is bookkeeping and accounting the same? There are subtle yet significant differences between the two that may be hard to notice.

Simply put, a bookkeeper records the day-to-day financial transactions of a business while accountants, in contrast, focus more on the big picture, including solutions on how to enhance the profitability of a business.

While accounting has been a straightforward task, the job itself has developed over the years and as a business owner, you need to have a perfect understanding of the two and how you can maximize its full potential for the benefit of your business.

Accounting vs. Bookkeeping

The two jobs may seem similar to one another as 79% of outsourced accounting firms offer both bookkeeping and accounting to their clients

Often, they also work side by side and both roles require almost the same set of skills and attributes. However, the differences exist and the distinctions are quite significant in terms of education requirements, skills required, and even job outlooks.

Bookkeepers and their roles in a business

Bookkeepers are tasked with the role of recording every financial data of the business, including journal entries and conducting bank reconciliations.

Having great attention to detail is important as a bookkeeper as any missed information, hidden mistakes in a budget or invoice can become a damaging issue to the business.

Often, bookkeepers are outsourced and work for different clients at the same time.

While a bookkeeper does not require any formal training, their job is just as important.

The information and data that the bookkeeper handles affect how the accountant will interpret the data and financial reports. Using this information, handle their expenses, tax issues, and other financial matters.

Bookkeepers usually take on different jobs involving the entry of financial data and transactions that a business occurs. Some of which include:

-

Implementation and maintenance of the business’ accounting software

-

Monitor bookkeeping policies and procedures.

-

Assigning of different expense categories.

-

Enter expenses and income into the software and track non-digital methods of payments, such as cash and checks.

-

Handle banking activities of the business.

-

Assist the accountant in preparations of financial statements, including the elimination of discrepancies and verifying recorded expenses.

Accountants and their roles in a business

The accountant’s role in every business is that they are the ones that would interpret the financial data provided.

However, it does not just stop at analyzing the numbers, as part of the job is the ability to possess sharp logic skills and problem-solving abilities.

Accountants draw from the information that the numbers present to drive significant and firm decisions for the company.

Accountants usually require certification to work either for a company or on their own with several projects.

It is one of the most in-demand positions in industries like insurance, health, small business, law, and even tax accounting firms.

Accountants may need certification to become a certified public accountant (CPA, which is a common goal by most accountants as this expands their income opportunities and even be able to service multiple clients at the same time.

Accountants play a vital role in your business success. They oversee important tasks that can help make or break your company’s success. Here are some of those that accountants usually cater to:

-

Analyzing financial data including profits, projections, and expenses of the business

-

Generating reports, performing internal audits, and preparing financial reports like tax returns, income statements, and balance sheets.

-

Accountants also provide forecasts of business trends and opportunities for growth within and outside of the business.

-

Helping business owners understand the impact of their financial and business decisions.

How to compare bookkeeping vs. accounting?

A comparison of bookkeeping and accounting showed that accountants look into the big picture of the business and its profitability through the data that their financials provide.

They have a higher skill set than a bookkeeper who is handling the actual recording of the company’s financial transactions.

Typically, a bookkeeper reports to an accountant.

A key difference between bookkeeping and accountancy is that while an accountant may also do the bookkeeping themselves, a bookkeeper would need additional credentials to pursue the roles of an accountant.

While the two roles can be easily defined, it is also important to understand the relationship between bookkeeping and accounting and the advantage of having these roles better synergized together so that your business can expand, grow its revenue and mitigate any risks.

These two roles can be similar and, more often than not, accountants and bookkeepers work side by side. These lines of work may require almost the same set of skills.

It is not an unusual move for a bookkeeper to gain more job experience, study, and the certifications to become a full-fledged accountant.

How can hiring accountants and bookkeepers benefit your business?

As your business grows, so does the amount of financial tracking that you would need to do to keep on track of vendors, customers, employees, and other essential parts of the business operations.

This can become more difficult to keep track on your own.

So many small businesses and even larger corporations rely on accounting services that provide the expertise that the business needs for its financial planning and tracking.

Accountants believe their profession will work best as it adapts to new technologies.

Therefore, accountants and bookkeepers in outsourced firms are up to date and enhance their expertise further because offshore companies easily adapt and invest in digital transformation.

This is highly beneficial for your business as it grows as new software can not only speed up the work but also give more information on how your business is doing and find new growth opportunities.

An expert offshore accounting firm like Offshore Business Processing can offer you the flexibility of having both for your accounting needs.

Offshore companies usually require their accountants and bookkeepers to have the proper training, screening tests, and certification to be deployed to their clients.

From a growth perspective, bookkeeping and accounting tasks for your small business may be too much to handle.

This is the perfect time to gain additional help and resources.

Whether you need only a bookkeeper or an accountant, the terms and scope of work may overlap however, it is important to understand the benefits and advantages of having both and having a reliable offshore partner that can provide the right accounting expertise that can drive more profitability and efficiency for your business.

Subscribe to our Newsletter

Get all our latest news, updates and exclusive offers delivered straight to your inbox.

Get all our latest news, updates and exclusive offers delivered straight to your inbox.

Get all our latest news, updates and exclusive offers delivered straight to your inbox.

Get all the latest CargoWise updates by subscribing to OBP's official newsletter.

Data Privacy Policy

Offshore Business Processing values, and respects the Privacy Rights of our Clients, Client's Customer, Business Partners, Contractors, Personnel, and other identifiable individuals or collectively "Individuals".

We are committed to protecting the privacy and confidentiality of Personal Data through adherence to our Data Privacy Principles and the implementation of reasonable and appropriate security measures to ensure fair, appropriate, and lawful processing.

Background and Scope

Offshore Business Processing as a global service provider goes beyond the borders of the residing countries. The global market requires not only the availability of communication, technology, and information systems but also the integrity and confidentiality of processing information including the Personal Data of Individuals that can be reasonably be determined from the information available.

This Data Privacy Policy sets the principles which emphasize the Offshore Business Processing's standard practices for the processing of Personal Data of Individuals. This Policy applies to all personnel and accredited 3rd party service providers who must act consistently with the principles contained in the policy. Domestic and industry-specific privacy statutory laws and regulations shall take precedence over this policy, to the extent applicable within the confines of conflicts of law principles.

Privacy Notice

This privacy notice describes the privacy practices for www.offshorebusinessprocessing.com. This applies to the Personal Information collected by this website. It will notify the user of the following:

- What personally identifiable information is collected from the user through the website, how it is used, and with whom it may be shared.

- What choices are available to you regarding the use of your data.

- The security measures in place to protect against the misuse of information.

How the user can correct any inaccuracies in the information.

Policy Changes on Websites

Any changes to our Data Privacy Policy and Privacy Notice will be made available on our website. If there are changes to how we treat our users' Personal Information, we will notify them via email or put a notification on our website.

The Personal Information/Data we hold about the users must be accurate and up to date. It is the responsibility of the users to ensure that Offshore Business Processing has up-to-date and accurate Personal Information and an active email address for your website update subscription.

What is Personal Information

Personal Information is any information whether recorded in a material form or not, from which the identity of an individual is apparent or can be reasonably and directly ascertained by the entity holding the information or when put together with other information would directly and certainly identify an individual.

Personal Information we collect on our website is First and Last Name, Email Address, Phone Number, and Company through our "contact us" page.

How and Why Do we Collect It?

Aside from our website, we obtain Personal Information in many ways including interviews, correspondence, by telephone and facsimile, by email, from your website, from media or publications, from social media, from other publicly available sources, from our website cookies, and third parties.

We collect your Personal Information for the primary purpose of providing our services to you, providing information to our clients, and marketing. We may also use your Personal Information for secondary purposes closely related to the primary purpose, in circumstances where you would reasonably expect such use or disclosure. You may unsubscribe from our mailing or marketing lists at any time by contacting us in writing.

When you visit our website, www.offshorebusinessprocessing.com, we automatically collect certain information about your device, including information about your web browser, IP address, time zone, and some of the cookies that are installed on your device. Click here to know more about our Cookies Policy. Additionally, as you browse the Site, we collect information about our web pages that you view, what websites or search terms referred you to the Site and information about how you interact with the Site. We refer to this automatically-collected information as "Device Information".

This website may include links to third-party websites, plug-ins, and applications. Clicking on those links or enabling those connections may allow third parties to collect or share data about you. We do not control these third-party websites and are not responsible for their privacy statements. When you leave our website, we encourage you to read the privacy notice of every website you visit.

Disclosure

Your Personal Information may be disclosed in some circumstances including the following:

- Third parties where you consent to the use or disclosure; and

- Where required or authorized by law.

Retention and Security Measures

Only authorized personnel has access to Personal Data and will be retained and disposed of in accordance with Offshore Business Processing's retention and disposal policies, guidelines, and applicable laws and regulations.

Offshore Business Processing implements appropriate and reasonable Technical, Organizations, and Physical Security Measures throughout the Data Life Cycle of the Personal Data that is collected. This involves preventing or at least reducing the probability of unauthorized/inappropriate access to data, or the unlawful use, disclosure, modification, and deletion to protect its confidentiality, integrity, and availability.

Quality of Personal Data and Access

It is important that Offshore Business Processing holds accurate, complete, and up-to-date Personal Data of identified Individuals. It is the responsibility of the Individuals to ensure that collected Personal Data is accurate, complete, and up-to-date. If the Individuals find that the Personal Data is outdated and inaccurate, they should advise Offshore Business Processing as soon as practicable so an update on records can be done and continued quality services will be provided.

Individuals may access, update and or correct the Personal Data by sending a letter of request subject to the approval of the management. Offshore Business Processing will not charge any fee for your access request but may charge an administrative fee for providing a copy of your Personal Data. To protect your Personal Data, we may require identification from you before releasing the requested information.

Contacting DPO

For questions and/or concerns regarding this Data Privacy Policy, use of your Personal Data, or your rights in relation to the Data Privacy Act of 2012, you may contact the Data Privacy Office in the following contact details:

Data Protection Officer

Email: dpo@offshorebusinessprocessing.com

Contact number: (+632) 7502-6411

Get all our latest news, updates and exclusive offers delivered straight to your inbox.

Get all our latest news, updates and exclusive offers delivered straight to your inbox.

Get all our latest news, updates and exclusive offers delivered straight to your inbox.

Get all the latest CargoWise updates by subscribing to OBP's official newsletter.

All Rights Reserved